Banking CRM Solutions: Turn Your Banking System Customer-Centric

It’s been three months and the execution process of demonetization is slowly settling down. From November 2016, cashless India has experienced a notable amount of transactions through plastic money.

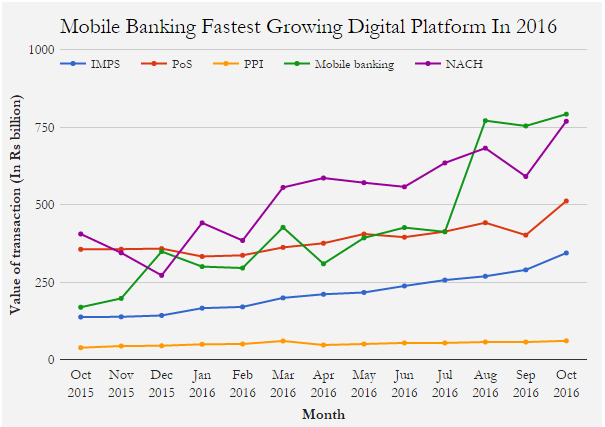

Money transfers using mobile banking and immediate payment system (IMPS)–wherein money is transferred instantly using text messaging or online banking–showed the highest spike in over 12 months, ending October 2016.

An India Spend analysis of Reserve Bank of India (RBI) data clarifies the situation. Mobile banking transactions grew 175%, whereas money transacted using mobile banking grew 369% from October to October, according to the report.

In this scenario, the greatest challenge of bankers is to build up a strong online banking CRM solution for the common people.

Information Management within the Volatile Economic Environment

The problem of information management is not unique for the banking sector, but the consequence is much severe than any other. The banking sector is the most sensitive industry in this sense.

Bankers, who rely on data derived from manual tools, are simply feeling the brunt these days. First of all, it is too slow to provide a minimum level of service to the customers. In this situation, bankers need rapid automation of customer data for fast and proper cash distribution.

Secondly, a minor inaccuracy can lead to major public agitation, as it may result in major financial tension. Manual tools fail to guarantee such accuracy, thus it would a completely obsolete gamble for the current situation.

In order to keep up with the present economy, you need real-time visibility into customer data. A cutting edge CRM system for banking sector can automate the customer information management system and ensure perfection in cash distribution.

With this information, bankers can make more informed choices, while managing cash positions and simultaneously assessing the risk related to those positions.

Accurate Risk Assessment

Risk assessment has become more important than anything in this age of demonetization. A severe shortage of hard cash, diverse demands from different areas, cash distribution in rural areas, people’s inability to handle online banking, and mutual collation process makes it difficult to quickly analyze the risk.

With CRM software you can get a 360-degree view of your customer and generate more organized data to analyze the upcoming potential risk.

Banking CRM solution manages to clearly integrate customers, processes and technology. It provides banks with an all-inclusive vision of all banking relationships and customer data, and stores it in a single data warehouse. You can access, edit, add, and analyze the data from a single dashboard.

Trust Management and Adaptation/ Acceptance Issues

70% of Indians live in rural areas. They have major trust issues related to online banking and cashless transactions. During the early phase of demonetization, they faced a lot of troubles regarding day to day activities, especially hospital and grocery expenses.

It is essential to make customers feel they matter a lot to a financial institution like a bank this will go a long way in gaining trust and building long term relationships.

With CRM software, you can offer 24*7 services, provide rapid response to customer queries, and leverage maximum connectivity with the common people. That is how you can gain customers’ trust so that they can get an uncompromised assurance of security.

After that only they will willingly adopt new modes of money transaction and banking.

In a Nutshell

CRM-based customer service methods can offer traditional customer service competencies that are further enriched by providing a complete picture of all customer communications. The formation and management of personalized or service-all marketing initiatives and pricing strategies are also streamlined and systematized. Most CRM systems also embrace social media integrating tools that allow you to track and reply to social media feedback, comments, and enquiries.

Leaving aside the debates regarding the long term effects of demonetization, India needs a more stable and organized banking structure to handle this economic reformation. A CRM system can provide a suitable and secure platform to upgrade and modernize the service pattern in the banking sector. It arms the bank with workflow automation and gives the users a sense of security and trust.

Kapture CRM software aims to empower your bank with the finest customer service tools.

play youtube,

play youtube,

xvideos,

xnxx,

xvideos,

porn,

Phim sex,

MP3 download,

Anime xxx,

porn,

sex xxx,

Flames C Maple Leafs,

javHD,